In this post:

- According to a poll conducted by analytics firm Teikoku Databank, businesses have opinions on abandoning the economic policies of Japanese Prime Minister Fumio Kishida.

- Residents hope for a possible 2025 reduction in bitcoin taxes and the return of centralized exchange trade, but not everyone believes that the government is being lenient toward companies or cryptocurrency owners.

- A failing middle class in Japan stands in stark contrast to developments like as Sony’s blockchain Soneium and good feeling regarding Ripple and stablecoins.

Local companies have evaluated Japan’s incumbent prime minister (PM), Fumio Kishida, through a Teikoku Databank survey, as he prepares to step down. Despite numerous ostensibly positive developments, Japanese corporations and cryptocurrency traders continue to harbor reservations about the administration, which is why Kishida performed worse overall than the former prime minister, Shinzo Abe.

According to a recent economics study conducted by the Japanese analytics company Teikoku Databank, outgoing prime minister Fumio Kishida underperformed Shinzo Abe.

When 1,924 enterprises were asked to rate the economic policy of the Kishida administration on a 100-point scale, the average result was 49.3. On the other hand, the average score of former prime minister Shinzo Abe in a prior study was 59.4, which is 10 points higher.

The ratings come as recent events involving Ripple, Sony, stablecoins, taxes, and discussion have focused on Japan’s economic policies and the country’s perceived “friendliness” toward cryptocurrency.

Some call the Kishida strategy ineffectual, while others rejoice over the “weak yen.”

According to data, “the smaller the company, the lower the evaluation,” according to a report from Japan’s Mainichi Newspaper

“Large companies have made big profits, but small and medium-sized companies have found it difficult,” bemoaned a chemical distributor who gave Kishida a score of 40.

“There were many ad hoc responses, so it was unclear what the government did, and the economic effect was not felt,” stated a different company involved in shipping and warehousing. They awarded just thirty points to the Kishida administration.

However, other companies welcomed the boost in stock prices and salary hikes. “We welcome the increase in stock prices brought about by the weakening of the yen and the implementation of the new NISA (tax-free small investment system).” The owner of the restaurant expressed this viewpoint and awarded the PM 50 points.

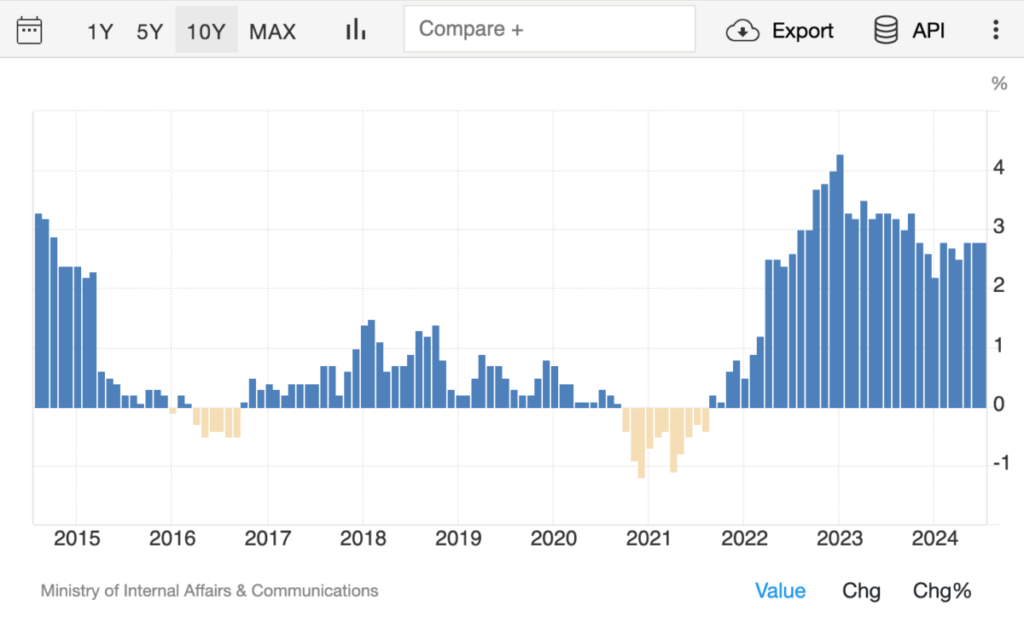

There are differences in perspective in the land of rising sun due to Japan’s continuous struggle with inflation and declining fiat purchasing power. Particularly when variations in economic class strata and dollar-to-yen exchange rates are taken into account.

Bulls in cryptocurrency are content. Throughout his time as prime minister, Fumio Kishida extolled the virtues of web3 development, even going so far as to “speak” (via video conferencing) at sizable conferences centered around digital assets, such as WebX Asia in Tokyo.

According to a recent estimate, there has been a resurgence in cryptocurrency trading on Japan’s centralized exchanges in 2024, with average monthly volumes increasing by almost $4 billion in comparison to 2023.

However, serious concerns regarding Japan and cryptocurrency in the future still exist. Even though there might be a tax relief in 2025 that would lessen the country’s absurdly high penalty for cryptocurrency gains, the up to 55% gouge still stands, and Kishida’s departure might result in even stricter regulations.

One such is PM candidate Taro Kono, the government’s Digital Transformation Minister, who advocates for closing down failing and “inefficient” companies and is planning a purportedly conservative reform that the Japanese media has dubbed “bloody.”

The Teikoku survey’s concerns about special treatment and profits for huge firms at the expense of everyone else are echoed in complaints about Kono’s extensive government intervention.

However, statements made earlier this month by Ripple CEO Brad Garlinghouse that “Japan’s leaders are committed to advancing crypto” and the seeming need for a yen stablecoin have managed to mask this deep undercurrent of disquiet in Japan. Notable blockchain advancements have also involved NTT, SBI, and Sony’s Soneium.

In a bitter irony, these events seem to have nothing to do with the Japanese namesake Satoshi Nakamoto’s invention of bitcoin as a decentralized, permissionless, peer-to-peer currency over a decade ago.

As the CEO of SBI Digital Asset Holdings, part of SBI Securities (Japan’s largest online brokerage), noted of the country’s perceived crypto-friendliness in a recent Bloomberg report: “…it’s not crypto easy.” This is in addition to the three largest banks in the country preparing for cross-border stablecoin payments as the election for the next Japanese prime minister draws near.