In this post:

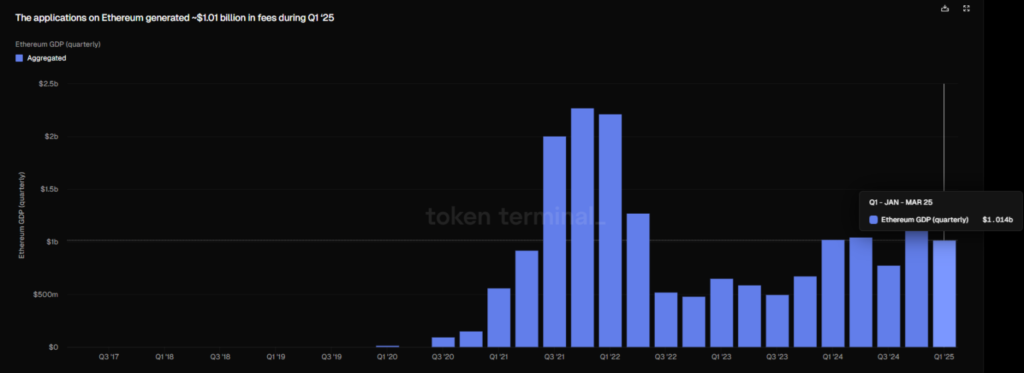

- In the first quarter of 2025, Ethereum apps—mostly DEXs and aggregators—generated over $1 billion in fees.

- In recent weeks, the L1 network offered much lower prices, generating $176 million in gas fees.

- While retail consumers trade and swap on less expensive networks like Solana and BNB Smart Chain, Ethereum is still a chain for whales.

As far as on-chain commerce is concerned, Ethereum (ETH) is still alive. In the first quarter of 2025, Ethereum-based apps generated over $1 billion in fees.

There is still a strong app ecosystem for Ethereum (ETH). Similar to 2024’s figures, the applications generated $1.01 billion in fees in the first quarter of 2025. During the 2021 market top, Ethereum apps generated almost $2 billion in fees; during the 2022–2023 bear market, they generated about $500 million.

Despite ETH trading at a lower range, Q1 activity and fee production levels were comparable to earlier quarters. After breaching above $1,600 lately, ETH stabilized around $1,548.73. With market concerns causing ETH to go below $1,000, the chain is being keenly monitored for indications of vitality and recovery.

According to recent data from Token Terminal, Ethereum is not a dead network, and there is still a baseline amount of activity on its apps. Some apps, however, attempt to avoid using the main network, and not all apps require on-chain transactions. The nature of the apps also contributes to high prices, with DEX swaps incurring the most reduction. The most popular distributed apps on Ethereum among daily users are Uniswap versions, which are followed by aggregators such as 1inch and CowSwap. Although Ethereum experiences somewhat less bot activity than Solana, the Banana Gun trade bot is also very active.

Apps with high fees have become popular on several chains, notably Solana (SOL). The main issue is that those apps frequently take value away from the ecosystem by keeping the revenues mostly for their developers. It would be necessary to liquidate or convert some of the apps’ ETH payments to stablecoins.

Ethereum remains the key platform for DEX ecosystem

Due to L2 scaling or off-chain processing, Ethereum’s L1 generates significantly reduced fees. The entire L1 network generated $176 million in fees for the first quarter of 2025, narrowly surpassing the Aave (AAVE) protocol.

Ethereum costs dropped as low as $100,000 per day before rising up to $1.4M. The chain ranks third in terms of fee generating, behind TRON and Solana. With substantially lesser inflows from transaction fees, block producers and validators continue to rely on ETH block rewards.

The average number of active daily addresses on the Ethereum chain is about 400K, which is comparable to the baseline level for the previous few years. Ethereum is a whale’s network, meaning it can handle requests for more liquidity than other networks with accessible on-chain operations.

Despite the relatively low traffic, DeFi apps on Ethereum generate significant fees due to the activity of whales and frequent traders. Ethereum retains 46.9% of all EVM-compatible trading volume, thanks to highly liquid DEX pairs. Ethereum DEXs are widely used to swap to and from WETH, as well as shift between various types of stablecoins.

One of the most popular gas burners and use cases is the Uniswap V4 router. Furthermore, one of the largest gas burners and fee earners is still the Tether smart contract.

Some of Ethereum’s small-scale retail consumers who once flocked to purchase meme tokens and NFTs have left the platform. In March, gas payments hit all-time lows as swaps cost $0.31 and normal transactions dropped to $0.02. When compared to the gas costs for Solana, BNB Smart Chain, or Arbitrum, those prices are still significantly higher.

With a weekly production of roughly 16,000 ETH, the chain continues to be inflationary, contributing to a total annualized inflation rate of 0.70%. Even while apps are able to increase their volumes and draw in whales, they are only using a little portion of ETH per day, keeping the remainder.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now