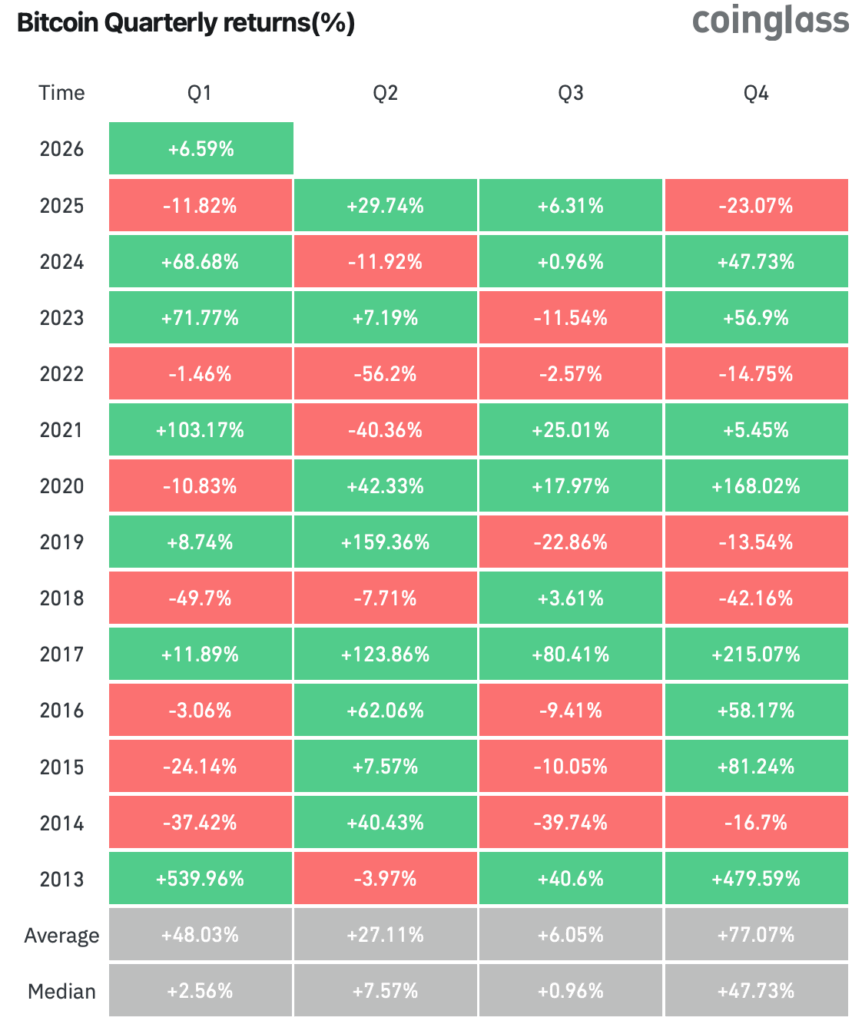

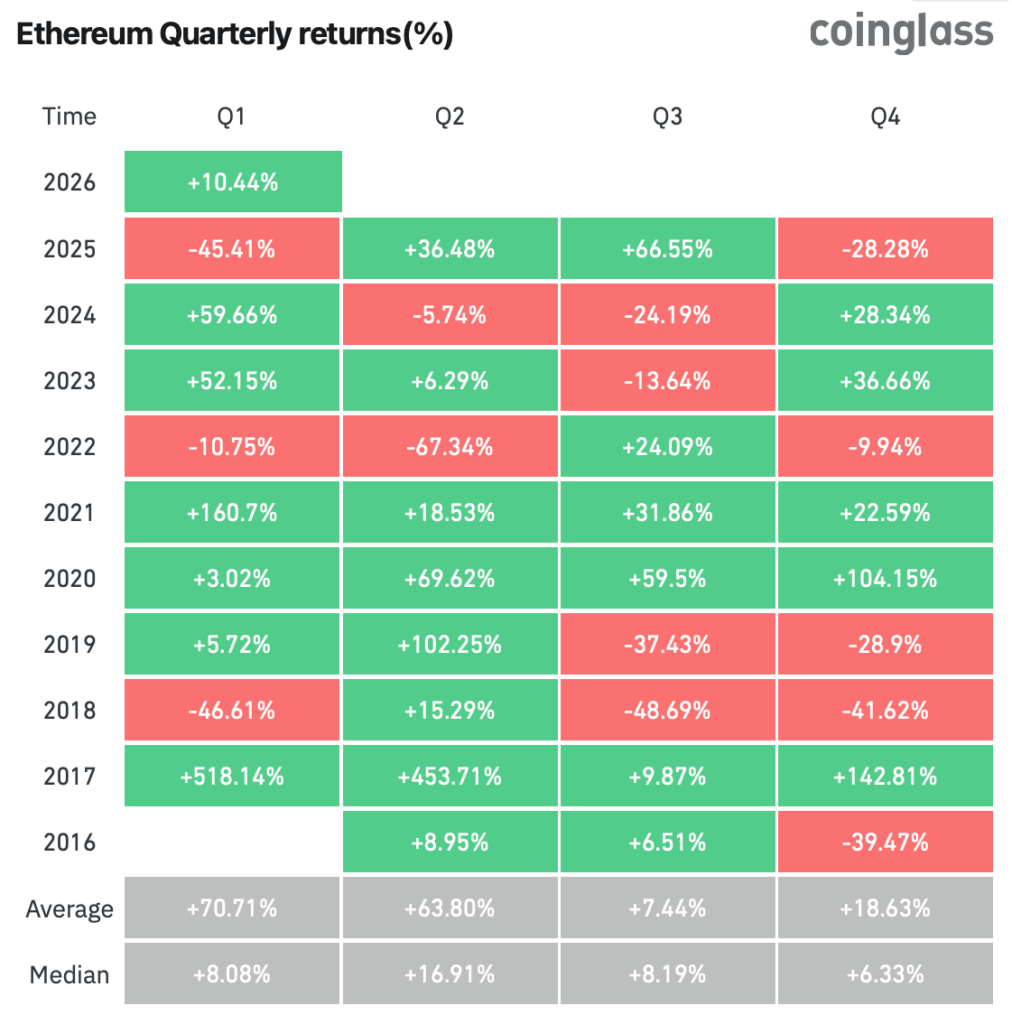

The reality is that Q4 2025 did not deliver in the explosive price action that many crypto traders were anticipating. However, since the turn of the year, fresh capital has begun re-entering the market after year end de-risking and tax-related selling fade.

Coupled with renewed institutional demand for new crypto Spot ETFs, existing ETF inflows picking up and certain on-chain indicators flipping positive, this points to a crypto market that is beginning to show structural strength.

Holiday Liquidity Removed

Bitcoin and Ethereum finished the last quarter of 2025 with a negative 23.07% and 28.28% respectively. These were the most severe drawdowns seen since 2019. The rest of the altcoin market, calculated by the Total 2 excluding stablecoins chart (TOTAL2ES), saw a steeper drop of close to 40%.

While arguably there were crypto specific factors that caused this decline such as selling pressure from long term holders, large Spot ETF outflows, deleveraging events throughout much of Q4. These moves were amplified by broader market forces. This includes thin year-end liquidity, as desks de-risked, books were closed and fewer participants were active, which allowed relatively modest flows to have a substantial impact on price.

As January trading begins, liquidity gradually normalizes and positioning resets, which is why markets often feel more intentional and driven less by forced selling and more by forward looking conviction.

Positioning Being Reset

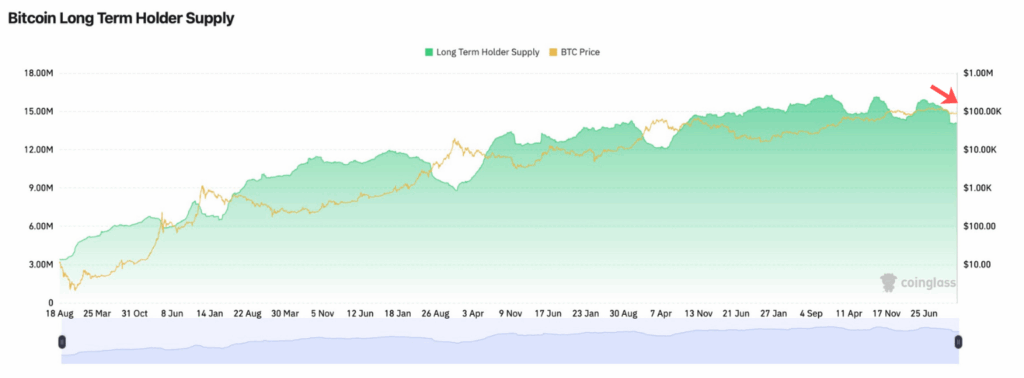

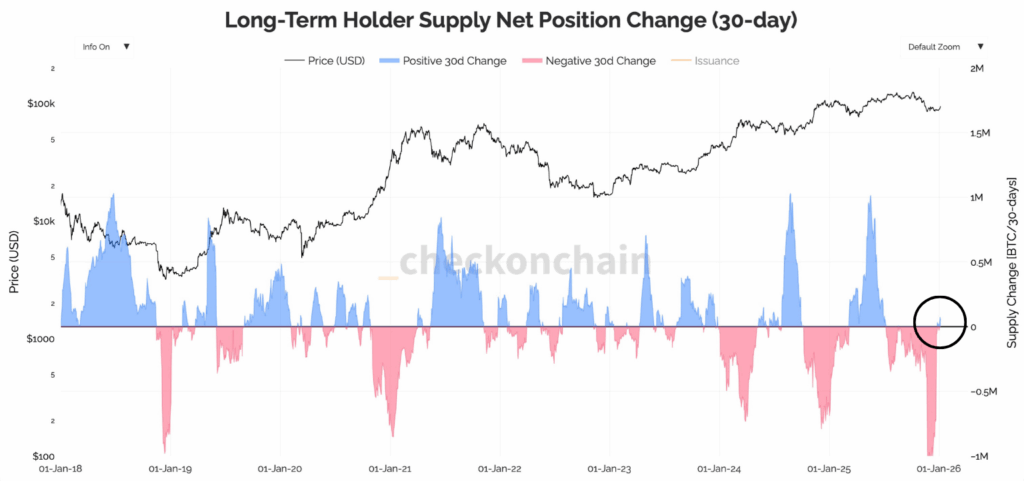

Towards the end of 2025, a narrative known as the “Bitcoin IPO moment” was gathering steem. This was a metaphor calling this a structural transition that allowed early and large holders to finally realize gains. The data shows us that there was a big cohort of long term Bitcoin whales that did sell throughout the second half of last year.

However this position is being reset as this group has begun accumulating again after heavy selling pressure since the 4th of July last year. This is usually an indicator of a bottom formation.

Sentiment Indicators Cooling

Since January 1st, around $249.7 Billion have been added to the total cryptocurrency marketcap. During this period, Bitcoin is up around 6% while altcoins have delivered stronger relative performance.

From a sentiment point of view, this rally has led the crypto fear and greed index to jump to 42, marking its highest level since October 2025. While sentiment is shifting positive, the YTD rally is being propped up by several factors including the positive on-chain point discussed above.

Firstly, we’re seeing a renewal in Spot ETF flows. On January 5th, U.S. Bitcoin ETFs saw $697 million in net inflows. This was the largest single day inflow seen since early October. Secondly, clarity around the crypto market structure bill in the U.S. is gaining traction again with the Senate Banking Committee scheduled to mark up the bill on January 15th. Lastly, the institutional backdrop is becoming incrementally more supportive with the news of Morgan Stanley’s filing to launch Spot Bitcoin and Solana ETFs with the SEC.

What Traders are Watching Now

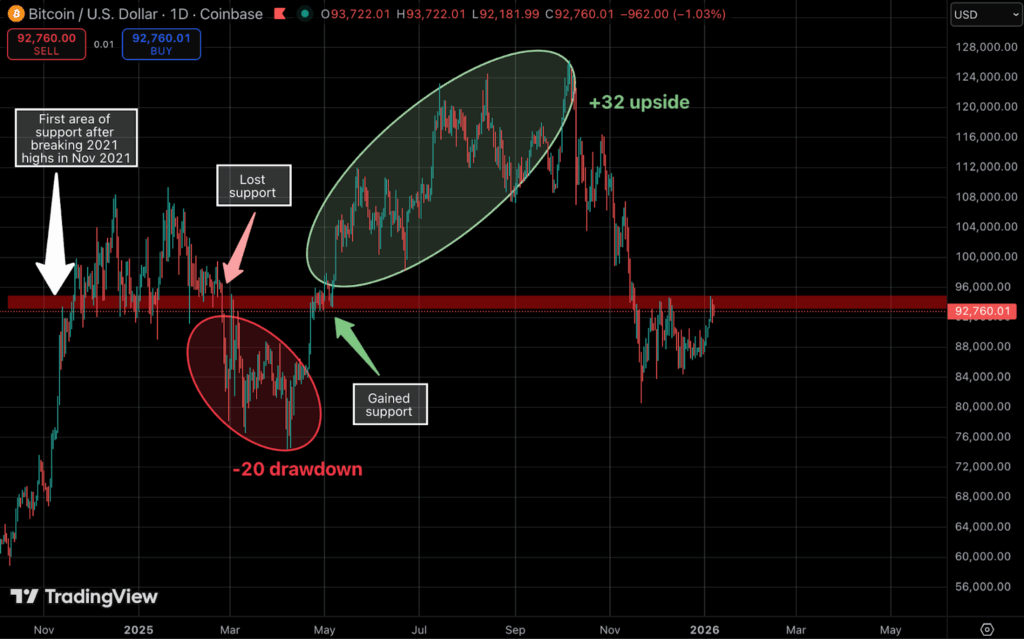

While the charts and data point to a change in market structure and sentiment, there are still key technical levels that need to be reclaimed before an extended bull rally can take hold.

Bitcoin is now entering a critical support and resistance range of $93K – $95K. This zone has acted as a long term level and the immediate price to reclaim is the $93K mark with a daily close.

If this range can be tested and held, the next hurdle is the $100K psychological level. Followed by this, there is a key technical level in the 50 week simple moving average which has historically acted as a bull market band. This level currently sits at $101.5K.

Until these key zones are decisively regained, price action can potentially remain range-bound and reactive, with traders watching closely for confirmation rather than chasing momentum.