In this post:

- With a 7.9% decline in the last day, the Ethereum Foundation sold $12.96M worth of ETH this year. Sales of ETH typically occur before market declines.

- As Ethereum funding rates fall to 0.052%, open interest drops by 5.51%, and US spot ETFs record $86.79M in withdrawals, bearish signals get more pronounced.

- With bearish setups suggesting a potential price decline approaching a support zone close to $3,061, analysts anticipate that ETH may begin a correction phase.

The Ethereum Foundation sold 100 ETH on Wednesday, according to Lookonchain. With 4,566 ETH sold so far, the sales followed a trend that has been noted since January 2, 2024.

The Ethereum Foundation has a history of selling ETH close to market peaks, which frequently precede market declines, per earlier Lookonchain research. The market tracker pointed out that the price of ETH has decreased by roughly 17% after the Ethereum Foundation sold 100 ETH in December of last year.

According to reports, the foundation has sold over $12 million worth of Ethereum in 32 trades over the last 12 months, with 15 of those deals taking place around market peaks.

The sale of the Ethereum Foundation depresses the market

In just ten minutes following the announcement of the Ethereum Foundation’s sell-offs, ETH lost 0.6% of its value. According to Coingecko data, the second-largest cryptocurrency by market capitalization has dropped 7.9% in the past day, and it is currently selling at $3,346 per coin.

Yumi Sumiko, a medium contributor, maintains that the foundation is selling Ethereum in order to pay for ongoing research and development within the Ethereum ecosystem as well as to manage its operating costs.

As a non-profit, Sumiko stated that it conducts these transactions to guarantee the financial viability of its programs rather than for commercial gain.

“The foundation does more than simply sit back and watch its money grow. Rather, it makes the deliberate decision to put money into Ethereum’s ecosystem, placing a wager that this blockchain will endure for a very long time. Sumiko repeated.

Ethereum (ETH) is presently developing a bearish setup, according to TradingView’s analysis. The price may move toward a support zone around $3,061 when it breaks down from a rising trendline close to a resistance zone. The fundamentals show that there is growing selling pressure, which supports this pessimistic outlook.

According to a new WaveTraders study, Ether is expected to have a large decline. ETH is presently in a negative corrective phase within a broader corrective pattern, according to their analysts.

This implies that Ethereum may be about to enter a phase when a more significant decrease is expected following a period of upward growth.

The market mood for Ethereum remains pessimistic.

Ethereum has remained consistently above the $3,000 mark over the last few months. However, investors who expected a spike towards new all-time highs have become somewhat pessimistic due to its stagnant movement.

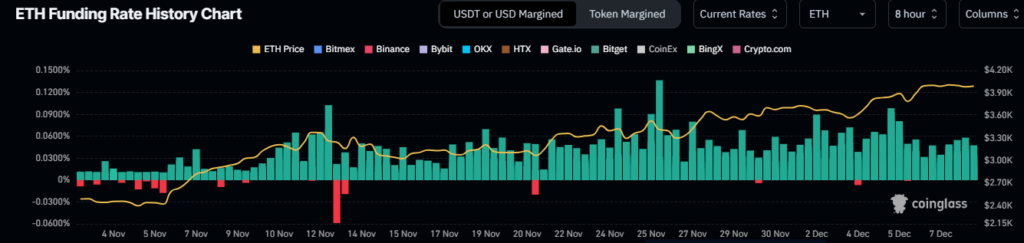

Telling trends can be seen in a review of ETH financing rates, a crucial measure of how aggressively people purchase or sell in the futures market. Funding rates skyrocketed as ETH approached the $4,000 threshold, indicating intense buying pressure.

It’s interesting to note that a string of protracted liquidations followed this peak, correcting the price and starting a consolidation phase. In the past day, funding rates have decreased from 0.093% to 0.052%, with $140 million in liquidations. At $118 million, bullish holdings took the brunt of the losses.

Widespread cryptocurrency market liquidations have caused a major setback for Ethereum derivatives, with open interest dropping by 5.51% to $30.42 billion. The long-to-short ratio has changed to a bearish 0.8968, indicating that traders are becoming more pessimistic.

US ETH spot ETFs showed a daily net outflow of $86.79 million, which added to the bearish momentum. Bears caused Fidelity to see $67 million in liquidations and the Grayscale Ethereum Trust to drop $11.19 million.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.