Like the broader cryptocurrency market, XRP has witnessed a shift in market structure to the downside ever since October 2025. Year to date XRP is down nearly -26% putting it on par with drawdowns witnessed by other large caps. Against this backdrop, attention has recently turned to XRP’s Community Day 2026, Ripple’s global virtual gathering that brings together developers, institutions and ecosystem leaders to discuss the next growth phase for XRP.

Held on February 11-12, 2026, the event took place across three regional X Spaces sessions covering EMEA, the Americas and APAC audiences. Ripple CEO Brad Garlinghouse, President Monica Long and XRPL co-creator David Schwartz were accompanied by representatives from major crypto and fintech companies like Grayscale and Gemini. The central themes throughout the event spanned across regulated financial products, ETFs, wrapped XRP, DeFi application, cross-chain liquidity and the expanding role of XRP in capital markets and real-world payments. The sessions also included live Q&As with Ripple’s leadership team and highlighted the company’s priorities for 2026 around institutional adoption and on-chain infrastructure.

Events like these in the crypto space often come with price volatility, sometimes even before the event begins, as expectations build around potential announcements, partnerships and ecosystem updates. XRP entered Community day in a consolidation phase after a volatile move to the downside and currently hovering around the key technical support level of around $1.35.

So far, the broader macro uncertainty and risk off sentiment that is coming down on the crypto market have outweighed the immediate impact of the announcements from the event. That said, optimism from such events often requires time to materialize and typically depends on whether the developments signal actual, structural demand rather than short-lived sentiment.

Event Optimism Building Within the Community

Despite price not reacting to the event from the get go, there was a clear message that came out from Community Day 2026. Throughout the event, the idea of the XRP Ledger being more than just a payments network and as an infrastructure for regulated finance came through. Institutional adoption, cross chain expansion and new developer tooling to strengthen XRPL’s role in tokenized assets were the core themes covered during the two day event. There were also discussions around its roadmap with emphasis being placed on programmability updates, compliance-friendly features and continued investment in the developer ecosystem. The themes and talking points ultimately showed a long term strategy focused on expanding enterprise and institutional use cases.

A major partnership was also announced during the event between Ripple and Aviva Investors, the global asset management wing of Aviva plc. The partnership aims to explore the tokenization of traditional fund structures on the XRP Ledger. This marks Ripple’s first partnership with a European investment manager and highlights a deeper push into tokenized finance. For Aviva investors, the initiative represents its first step toward incorporating on-chain fund structures. This partnership once again exemplifies the long term narrative of XRP becoming a key player bridging traditional finance and blockchain-based infra.

Historical Impact of Major XRP Events

History often suggests that crypto events can play into the “buy the rumor, sell the news” dynamic and this has been observed in previous XRP events as well. For example, Ripple’s annual Swell conference has acted as a short term price catalyst in the past. Take Swell 2023 for instance, XRP rallied by nearly 50% for four weeks leading up to the conference, only to be followed by profit taking.

However, news around regulatory clarity had a much more long term impact and momentum to price. The news around the U.S. SEC dropping the long standing Ripple lawsuit in March 2025 not only had an immediate impact on price but saw a durable momentum all the way up to August of the same year when the case was officially closed. During this period XRP’s price rallied by nearly 46%.

Market Structure Remaining the Deciding Factor

Even though the Community Day might’ve brought in fresh narratives, the broader macro environment continues to influence market structure and sentiment across asset classes including crypto. The entire crypto sector remains heavily influenced by global liquidity conditions, interest rate expectations and risk appetite.

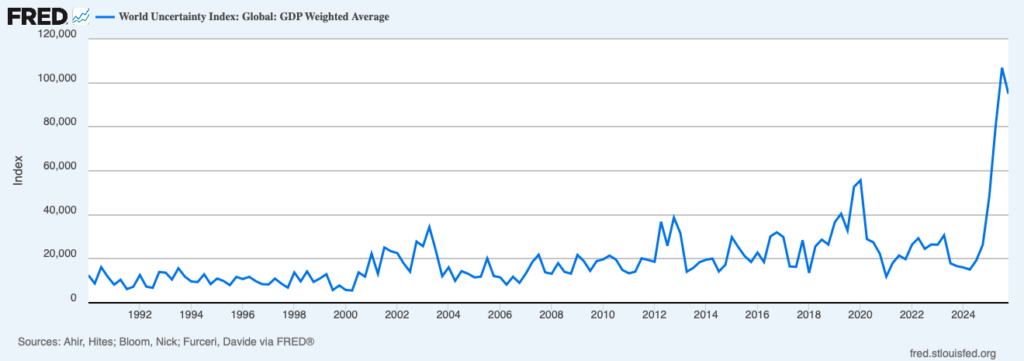

Currently, global uncertainty is impacting the crypto market. Economic unpredictability is at unprecedented levels and this is indicative by looking at the World Uncertainty Index. This index is used as a barometer to judge global economic uncertainty by tracking how frequently uncertainty related terms appear on economic and policy reports across the globe. For perspective, this index is now higher than levels seen during both the pandemic and the 2008-2009 financial crisis.

Ultimately, this level of fragility in the macroeconomic environment makes it extremely difficult for any sort of event-driven news to gain traction. Global sentiment and external macro forces currently remain the key parameters to keep close eyes on for a momentum shift in XRP and the broader market.

Levels Traders are Watching

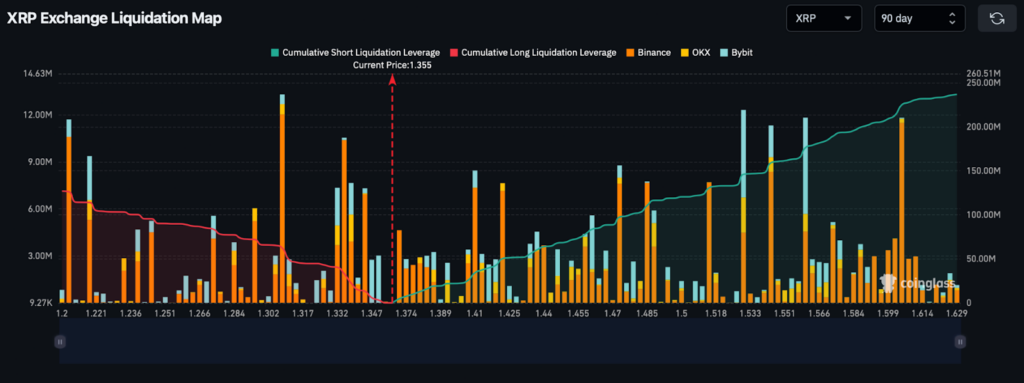

After breaking the April 2025 lows of $1.61 on February 1st, price has dropped by another 15% and is now testing a key support zone between the $1.30 to $1.35. Traders are watching this level because this coincides with a cluster of price activity all the way back to August-October 2021. Zones with repeated historical reactions often become important battlegrounds between buyers and sellers.

Derivatives positioning also highlights similar areas of interest and where we could potentially see volatility. When we look at XRP’s three-month liquidation heatmap, a large portion of long liquidations has already been cleared by the recent decline. However, a pocket of long leverage still sits below the current market price, particularly in the $1.30 to $1.25 region. At the same, significant short liquidation clusters are emerging between $1.50 and $1.63.