In this post:

- For the first time, Tether’s stablecoin USDT has surpassed a $120 billion market valuation, marking a significant milestone.

- According to experts, the rise in USDT’s market capitalization may portend an impending bull run.

- The stablecoin market cap, which has grown for more than a year in a row, is dominated by USDT.

For the first time, Tether’s stablecoin USDT has surpassed a $120 billion market valuation, marking a significant milestone that may indicate optimism for the larger cryptocurrency market.

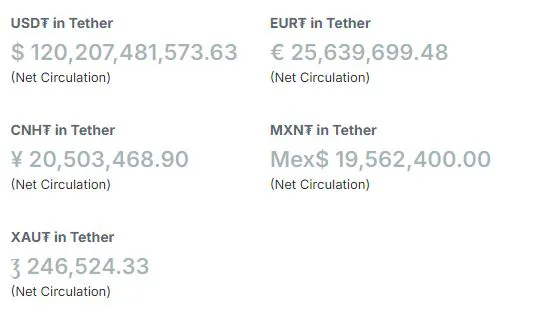

Tether’s website, which provides real-time data on USDT’s supply, was updated on October 20. The stablecoin crossed the $120 billion market cap threshold for the first time and has been increasing rapidly ever since.

Blockchain developer, operations security specialist, and CTO of blockchain platform Komodo Kadan Stadelmann told Cryptopolitan that USDT’s milestone is a “positive indicator that Bitcoin and the wider crypto asset index is moving into a new bull market” in the near term.

Stablecoins serve as a bridge connecting digital assets and fiat money. Because it implies that investors are stockpiling stablecoins before making cryptocurrency investments, a growing stablecoin supply is frequently seen as a hint of an upcoming bull run.

However, a dearth of stablecoin inflows may also be a sign that the market is correcting itself.

USDT is backed by Treasury bonds. For that reason, it has more backing than actual US Dollars. Since Tether earns 5% holding Treasury notes, they take their interest earned and buy Bitcoin.

– Stadelmann.

“This business model has led to the stablecoin surpassing a $120 billion market cap,” he continued. Historically, the inflows have indicated that people are expecting a cryptocurrency bull market.

Tether’s treasury inflows indicate that a sizable amount has been transferred to centralized exchanges (CEXs). According to Arkham Intelligence data, Coinbase, Kraken, and Binance have had large inflows in the past week.

Stablecoins might be the currency of the future.

In addition to possibly igniting a bull run, Stadelmann believes that USDT’s increasing market capitalization may portend bigger shifts in the cryptocurrency industry down the road.

One potential outcome has been the widespread use of Bitcoin as a currency. But according to Stadelmanns, the increasing dominance of USDT could lead to a very different situation.

A sounder kind of money vanishes from circulation when it competes with a less sound one, according to Gresham’s Law. It makes sense that if Bitcoin is widely used, USDT will be used for transactions and Bitcoin will be kept as a safety net.

On-chain analytics platform Token Terminal reported in a post on September 26 that Tether’s stablecoin currently holds a two-thirds market share after gaining substantial traction over the previous two years.

“On-chain numbers are truthful. As of Q3 2024, USDT has 330 million on-chain wallets and accounts, including four consecutive quarters with an average growth of 9% and Tether’s highest-ever quarter with 36.25 million users, according to Stadelmann.

“There are still more Tether off-chain users who use exchanges to store their USDT.”

The larger stablecoin market reaches all-time highs.

After more than a year of steady growth, the total market capitalization of stablecoins has likewise hit a new all-time high of $171 billion. According to DefiLlama data, the overall market capitalization of stablecoins has surpassed the previous milestone, which was reached in March 2022, and is now at its highest position ever.

In March 2022, the market hit a record high of $167 billion, then eventually fell to $135 billion.