In this post:

- Coinbase allegedly demanded 500 million TRX (about $80 million) for a listing, according to Justin Sun.

- Simon Dedic and Cronje drew attention to exchanges’ expensive listing practices, including fees of up to $100 million.

- The co-founder of Binance explained their screening procedure.

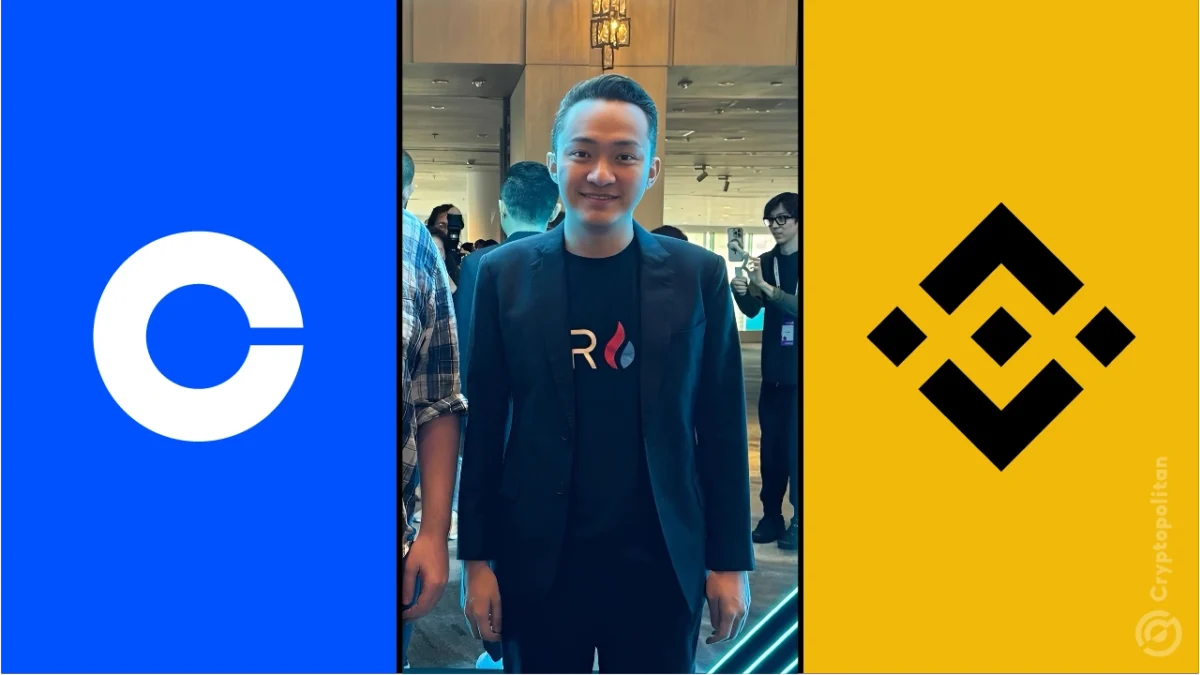

Regarding the Coinbase fee structure for listing cryptocurrency assets on the exchange, Justin Sun raises concerning assertions. He claimed that he was required to pay 500 million TRX, or roughly $80 million, to the largest cryptocurrency exchange in the US.

This contradicts recent remarks made by Coinbase CEO Brian Armstrong, who implied that asset listings on his cryptocurrency exchange are free and even offered assistance to Simon, the CEO of Moonrock Capital.

Binance and Coinbase are charged with demanding large stakes.

In a previous post, Simon Dedic claimed that after wasting more than a year of due diligence with Binance, a Tier 1 project that raised nearly nine figures was eventually offered a listing. He went on to say that 15% of the project’s token supply was requested by the largest cryptocurrency exchange in the world based on trade volume.

According to him, projects cannot afford to pay $50 million to $100 million for a listing on a controlled exchange, and these coins are the main cause of bleeding charts. The CEO of Coinbase used the occasion to advertise its self-proclaimed free listing.

Andre Cronje jumped into the matter and mentioned that Binance charged $0 to them while Coinbase asked them for $300 million, $50 million, $30 million, and recently $60 million. He refuted Armstrong’s claims of free listing.

He went on to say that he is not bound by any NDA and is happy to produce documentation of requests made by several Coinbase staff members. Cronje emphasized that these requests were sent over Slack, Telegram, and email over a period of several years.

He made a suggestion that Coinbase would contend that it was a “earn fee” rather than a “listing fee,” which yet equates to a “cost to be listed.” He even prepared to share all the information on social media, though, so that others could make their own decisions.

When Justin Sun attempted to get listed on Coinbase, he encountered a similar circumstance. He claimed that in order to improve their performance, the exchange requested that they pay 500 million TRX and even required a $250 million Bitcoin deposit in Coinbase Custody.

Binance co-founder responds to listing fee drama

Yi He, a Binance co-founder, tried to clear the air about the emerging issue. She stated that if a project does not pass the screening process then it cannot be listed on Binance regardless of the amount of money or tokens involved.

She went on to say that the largest cryptocurrency exchange in the world has projects listed in the token distribution column. She requested people to examine the proportion to see whether there is a so-called 20%, 15%, or something comparable.

Yi He emphasized the guidelines for airdrops via Binance’s launch pool and additional listing techniques. She failed to mention that Binance may add any project that was willing to do airdrops. In the meanwhile, she commended Cronje for having the courage to speak the truth in the midst of the chaos.