The South African trading community has always been quick to embrace innovation — from the early adoption of Forex trading to the recent surge in Crypto adoption. Now, there’s a new player in town changing the way traders engage with the markets: Bybit TradFi. South African traders looking to diversify their portfolio, earn passive income, and tap into professional-grade trading tools all from one platform, look no further; Bybit’s TradFi might just be the breakthrough they’ve been waiting for.

Bybit Fintech FZE is a Juristic Representative of Altify SA Capital (Pty) Ltd, an authorised financial services provider (FSP no. 52727), registered under South African company number 2022/321703/07.

What is Bybit TradFi?

Bybit TradFi is an integrated trading feature that combines traditional finance (TradFi) principles with the speed, transparency, and accessibility of Crypto technology. In other words, the best of both worlds a secure, easy-to-use product where users can:

- Trade Forex with competitive spreads.

- Access Crypto markets with deep liquidity.

- Earn passive income through flexible and fixed-term investment products.

- Manage their portfolio from one intuitive dashboard.

For South African traders who want exposure to multiple asset classes without juggling multiple accounts, TradFi is the perfect solution.

Why South African Traders Should Pay Attention

South Africa’s financial landscape is dynamic. The Rand (ZAR) can be volatile, and inflationary pressures have pushed many locals to seek hedges in Forex and Crypto. This makes multi-asset platforms like Bybit TradFi highly relevant.

What makes Bybit TradFi stand out:

1. Multi-Market Access

TradFi allows users to seamlessly trade USD/ZAR forex pairs, global commodities, and top cryptocurrencies all without leaving the platform.

2. Institutional-Grade Security

Bybit’s multi-layer security architecture ensures that traders’ assets are protected with cold storage, two-factor authentication, and real-time risk monitoring.

3. Passive Income Opportunities

Beyond trading, South Africans can stake stablecoins, invest in fixed-income products, or try structured savings all powered by blockchain transparency.

4. Low Fees & High Liquidity

Bybit offers competitive trading fees and deep liquidity pools, allowing execution of large orders without significant price slippage.

How to Get Started with Bybit TradFi in South Africa

Getting started is straightforward:

- Sign Up on Bybit and complete the quick KYC process.

- Deposit Funds via P2P, Crypto deposit or ZAR onramp/ One Click Buy

- Explore TradFi from your dashboard — choose forex, crypto, or passive income products.

- Monitor & Optimise your portfolio with built-in analytics tools.

The Tech Behind TradFi

Bybit TradFi isn’t just a trading feature — it’s a financial ecosystem. Leveraging Blockchain infrastructure for transparency and advanced trading algorithms for execution speed, it ensures South African traders get a Wall Street-grade trading experience without the institutional barriers. This is particularly important in 2025, where algorithmic trading, AI-assisted portfolio management, and tokenised assets are rapidly becoming the norm in global finance. TradFi positions its users to be part of that future.

For South African traders navigating the challenges of currency volatility, rising inflation, and the fast-moving world of digital finance, Bybit TradFi offers a secure, innovative, and all-in-one solution. TradFi delivers the technology and flexibility needed to trade the markets actively or grow wealth passively.

To experience the future of trading, sign up for Bybit TradFi today and unlock the power of multi-asset trading in South Africa.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralised world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralised finance at Bybit.com.

For updates, please follow:

Bybit Africa (@bybit.africa) • Instagram photos and videos

Bybit Africa (@bybit.africa) | TikTok

Bybit Africa (@BybitAfrica) / X

Risk Disclosure

This article is provided solely for informational purposes. The opinions expressed herein do not constitute investment advice or recommendations, nor should they be regarded as such. This document does not represent an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the investments mentioned.

Bybit operates as an exchange facilitating the reception and transmission of crypto asset orders, without providing investment advice or personalised recommendations. While Bybit advocates for the broader accessibility of cryptocurrencies, they may not be suitable for every investor.

It is important to consider your investment goals, experience level, and seek independent financial advice where necessary. Bybit strongly recommends conducting comprehensive research before investing in cryptocurrencies.

Investors are solely responsible for their own investment decisions. Considering the high volatility associated with cryptocurrencies, please evaluate your financial circumstances carefully before engaging in transactions. Cryptocurrencies carry a high risk, with potential for both significant gains and losses. Investing in cryptocurrencies may lead to a total loss of capital.

Past performance is not indicative of future results, and returns cannot be guaranteed as cryptocurrency values fluctuate based on market supply and demand. Do not invest more than you can afford to lose and seek professional guidance if you are unsure about the suitability of a cryptocurrency investment for your specific situation.

]]>

RYO Digital and GRNX Global Partner to Revolutionize Global Grain Trade with Blockchain Innovation Tokyo, May 6, 2025 – RYO Digital and GRNX Global have officially entered into a working agreement to redefine the global grain trading industry through blockchain technology. This strategic collaboration brings together RYO Digital’s next-generation digital payment ecosystem and GRNX Global’s GrainX Protocol grain tokenization platform, creating unparalleled efficiency, transparency, and accessibility in global commodity trading.

Transforming Global Grain Trading

The $1.6 trillion global agricultural commodities market has long been plagued by inefficiencies, slow transactions, and outdated financial systems. RYO Digital and GRNX Global are changing that by bringing decentralization, security, and frictionless payments to international grain trade.

Through this collaboration:

• RYO Digital will serve as a trusted payment solution, offering lower costs, faster settlement, and enhanced security compared to traditional banking mechanisms.

• GrainX Global will facilitate a seamless, traceable, and smart-contract-driven marketplace for Canadian grain exports, particularly to Japan’s multi-billion-dollar beer brewing industry.

• GrainX Protocol will provide new financial tools to facilitate faster farmer payments and lower cost grain buyer inventory lending, which will strengthen the agriculture financial ecosystem.

• Blockchain-backed lending pools will revolutionize trade finance, ensuring liquidity and reduced risk for producers, buyers, and traders alike.

A Groundbreaking Synergy

This alliance represents a powerful integration between digital assets and real-world commerce. RYO Digital, a project built from Japan, and recognized for its compliance with Japan’s stringent regulations, provides a stable and secure means for commodity transactions, eliminating inefficiencies associated with fiat-based trade. Meanwhile, GRNX Global’s platform enables real-time settlement, automated contract execution, and verifiable supply chain transparency for grain producers and exporters.

Disrupting Japan’s Agricultural Supply Chain

Japan’s agricultural and brewing industries rely heavily on high-quality Canadian grain. Through this partnership:

• RYO Digital will enable Japanese buyers, including major brewing companies, to seamlessly purchase Canadian grain with instant, low-cost blockchain transactions.

• GRNX Global will ensure full traceability, smart contract settlements, and improved financial instruments to modernize international trade.

• The collaboration will support Japan’s push for blockchain adoption, ensuring compliance with financial regulations.

Blockchain’s Role in the Future of Commodity Trading

This partnership redefines how blockchain is applied to real-world industries. Beyond digital transactions, RYO Digital and GRNX Global are reshaping the way commodities are traded, financed, and settled.

• Real-World Utility: Unlike speculative cryptocurrency projects, GrainX Protocol is directly tied to real-world trade, creating measurable economic benefits for businesses and industries.

• Institutional-Grade Trust: By aligning with regulatory frameworks and integrating blockchain into established industries, RYO Digital, GRNX Global, and GrainX Protocol are positioned as the go-to digital asset for compliant and secure payments.

• Scalability & Growth: The model created through this partnership can be replicated across other commodity sectors, including oil, metals, and other agricultural exports.

• As part of their commitment to sustainable trade, RYO Digital and GRNX Global will explore blockchain-based carbon credit integration to incentivize eco-friendly agricultural practices. This initiative will enhance transparency in carbon trading while supporting greener supply chains.

Executive Endorsement

Anthony Diaz, Founder & Chairman of the RYO Project, stated: “This partnership with GRNX Global and GrainX Protocol is a game-changer. Together, we are not just integrating blockchain into commodity trading—we are transforming an entire industry. By bridging traditional markets with cutting-edge digital assets, we are creating real economic value, driving financial innovation, and setting a new global standard for efficiency, transparency, and accessibility in trade.”

Jason Dearborn, CEO of GRNX Global, added: “Partnering with RYO Digital allows us to unlock the full potential of blockchain in the agricultural trade sector. The integration of digital assets into global grain trading is long overdue, and this initiative will be a game-changer for exporters, buyers, and financial institutions alike. GRNX Global is looking forward to working with such an innovative and respected global digital payment ecosystem partner.”

About RYO Digital

RYO Digital is a next-generation digital payment ecosystem designed to revolutionize global transactions by providing a compliant, efficient, and secure alternative to traditional financial systems. Built for mass adoption and real-world application, RYO Digital integrates cutting-edge blockchain technology with seamless payment solutions. www.ryocoin.com

About GRNX Global

GRNX Global is a Canadian partner-driven ecosystem committed to improving the financial outcomes for Canadian grain farmers and licensed grain buyers through integrated technology, services, and financing solutions. It is an innovative blockchain solutions provider focused on real-world asset tokenization, smart contract automation, and trade finance transformation. Through its flagship GrainX Protocol token, GRNX Global is pioneering the digitalization of agricultural commodity trading, enabling seamless cross-border transactions with blockchain technology. www.grnx.global

About GrainX Protocol

GrainX Protocol is a CeDeFi solution unlocking liquidity for the global grain trade by connecting onchain capital with real-world grain contracts, market data, and verified delivery records. Developed in partnership with GRNX Global, GrainX Protocol aims to become the financial layer for decentralized agricultural commerce. GrainX Protocol has recently opened their token seed round which is available to investors via a SAFT. www.grainx.fi

For media inquiries, partnership opportunities, or additional information, please contact:

RYO:

[email protected] www.ryocoin.com

GRNX Global:

Ken Jackson – [email protected] www.grnx.global

REVOLUTIONIZING THE FUTURE OF GLOBAL TRADE WITH THE POWER OF BLOCKCHAIN TECHNOLOGY.

]]>

Mr. KEY Talks AI Governance, Risk & Compliance at Crypto Expo Dubai — KEY Wire TEST

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

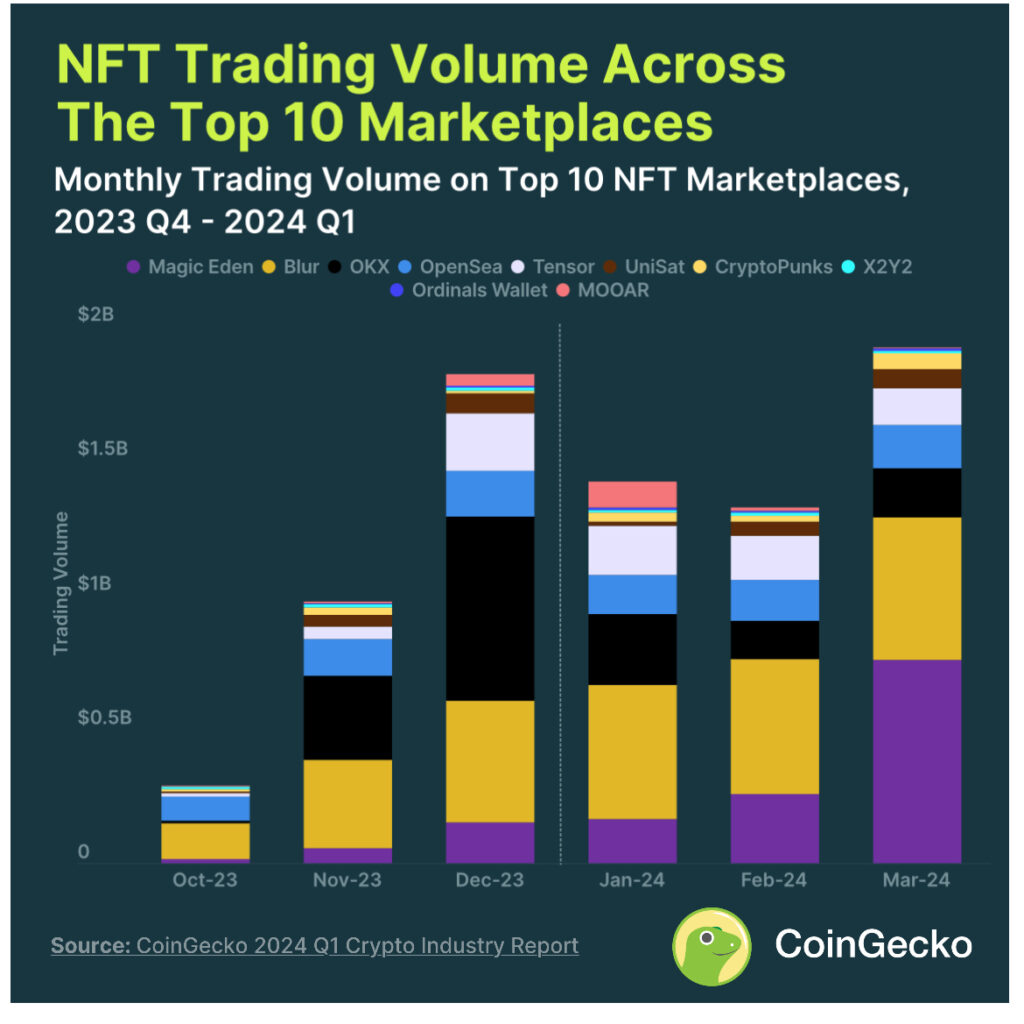

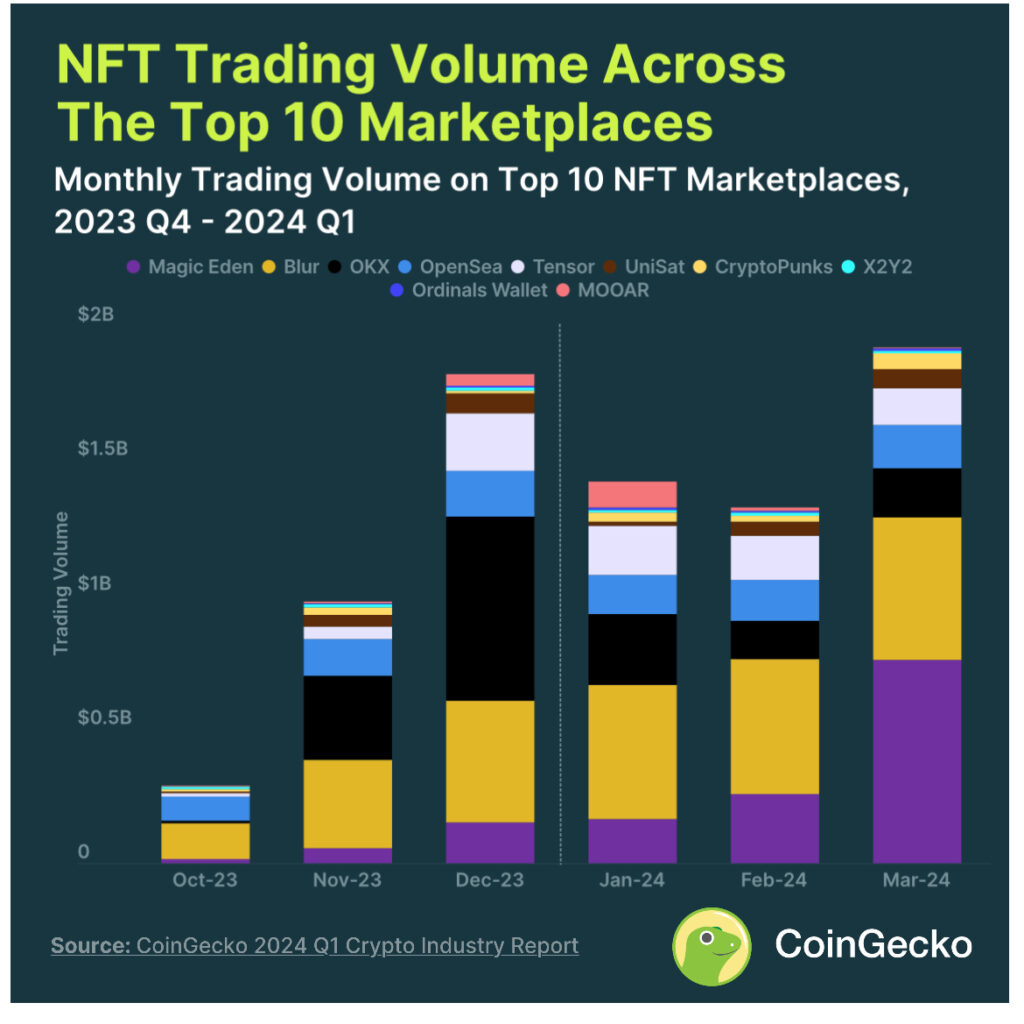

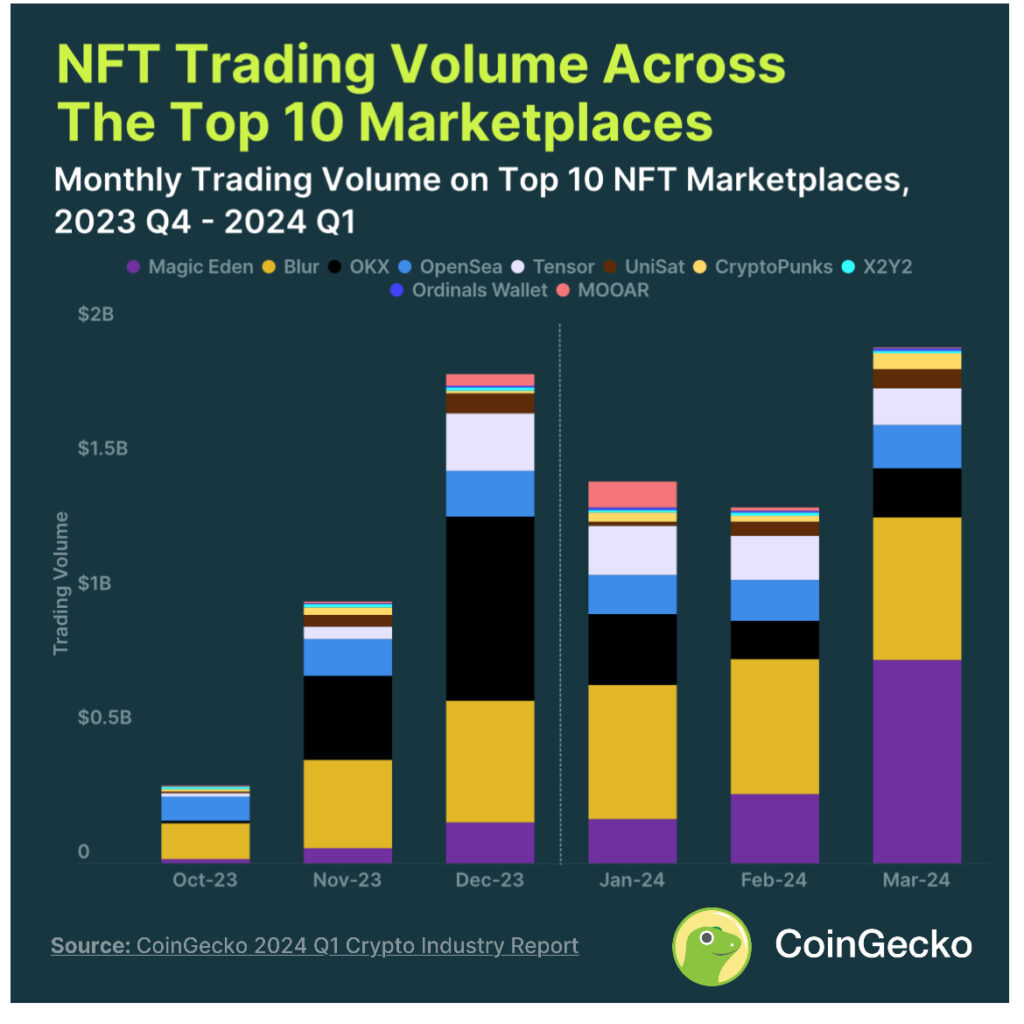

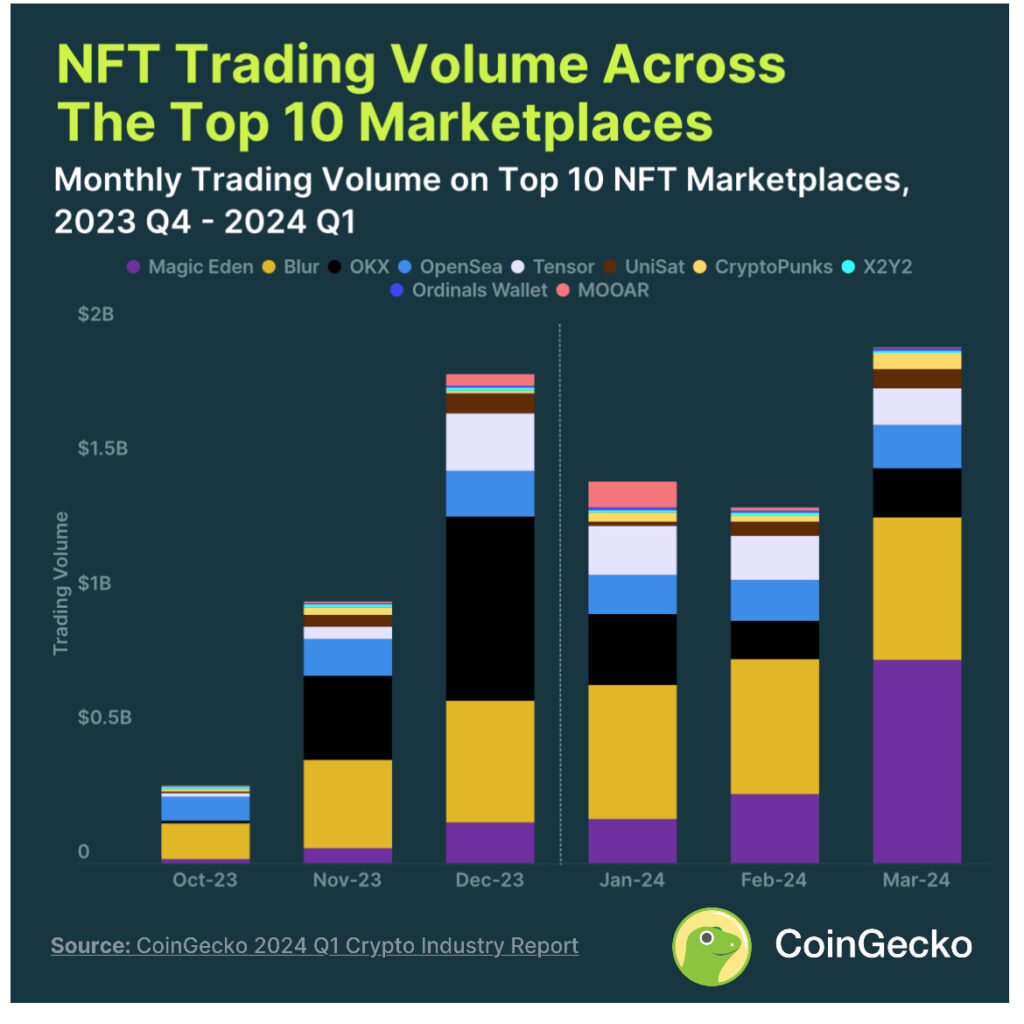

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

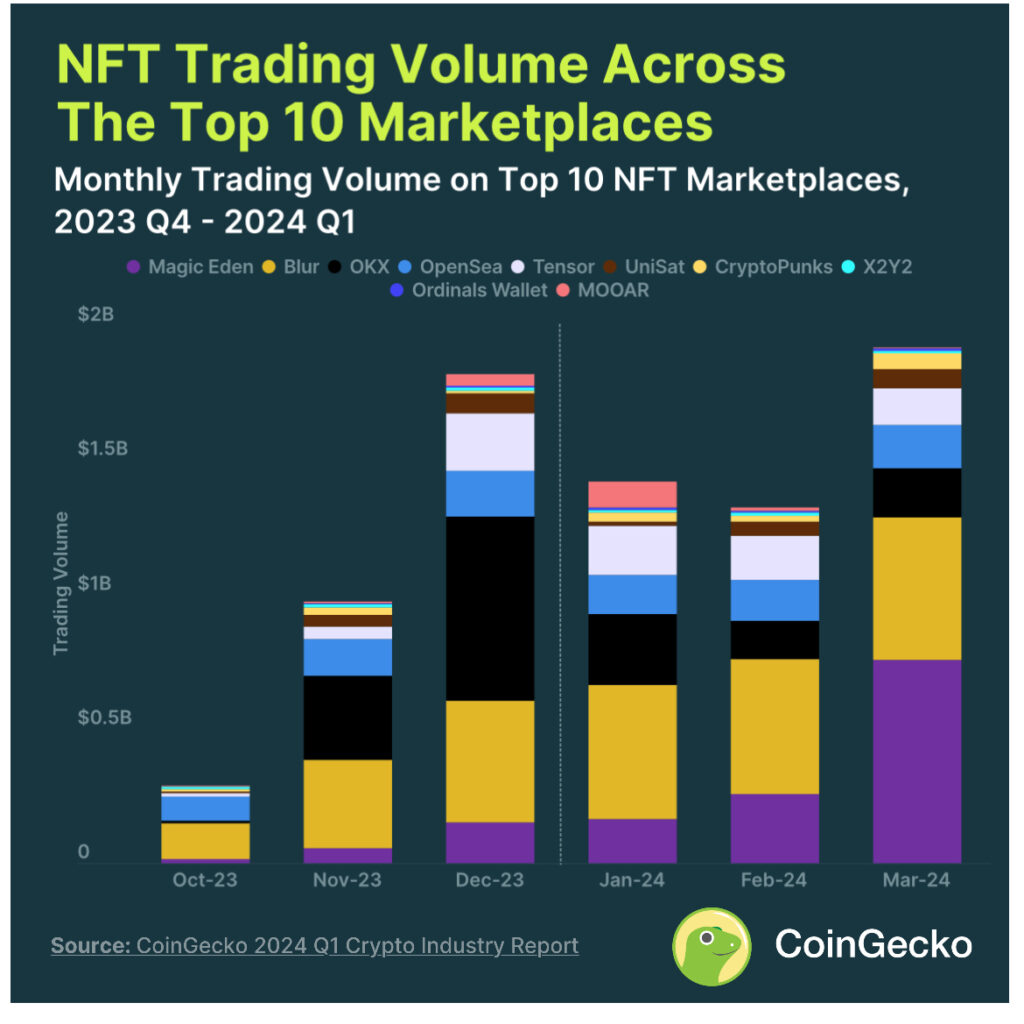

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

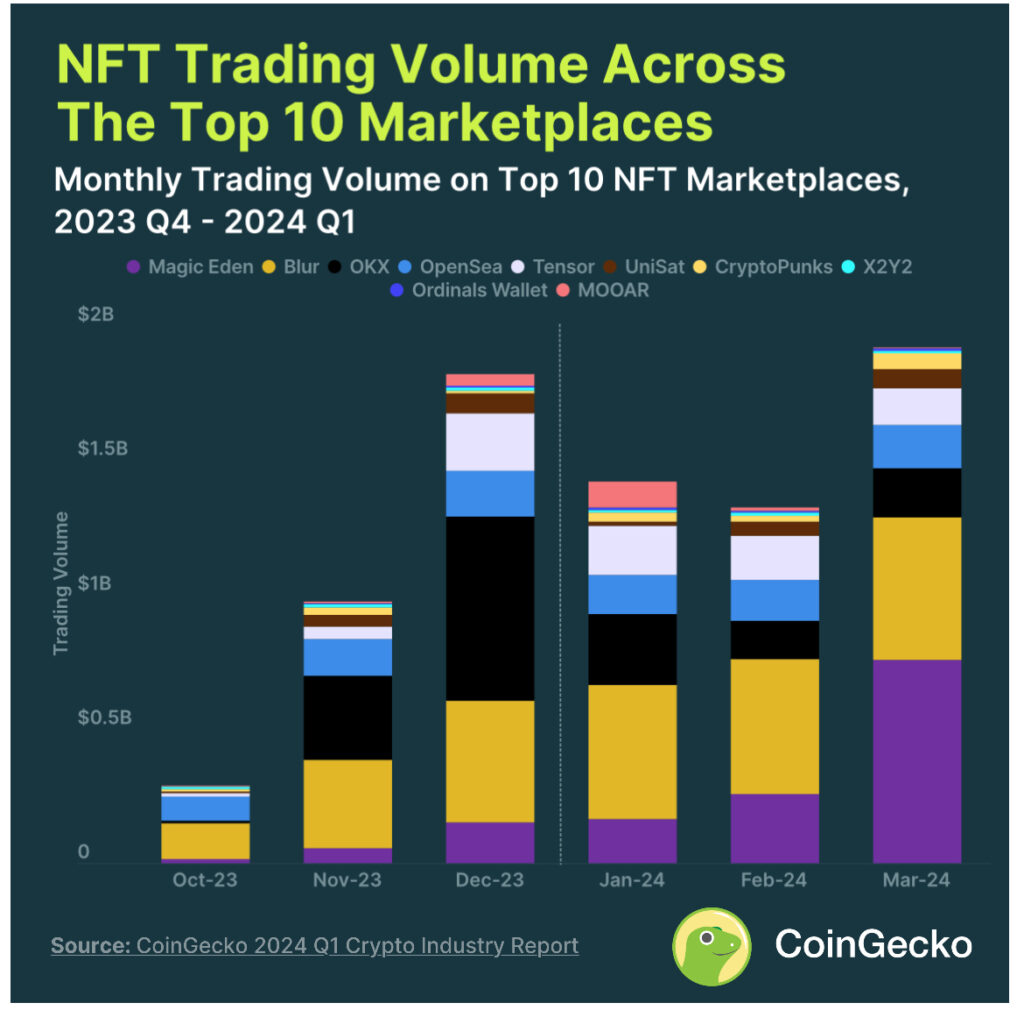

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

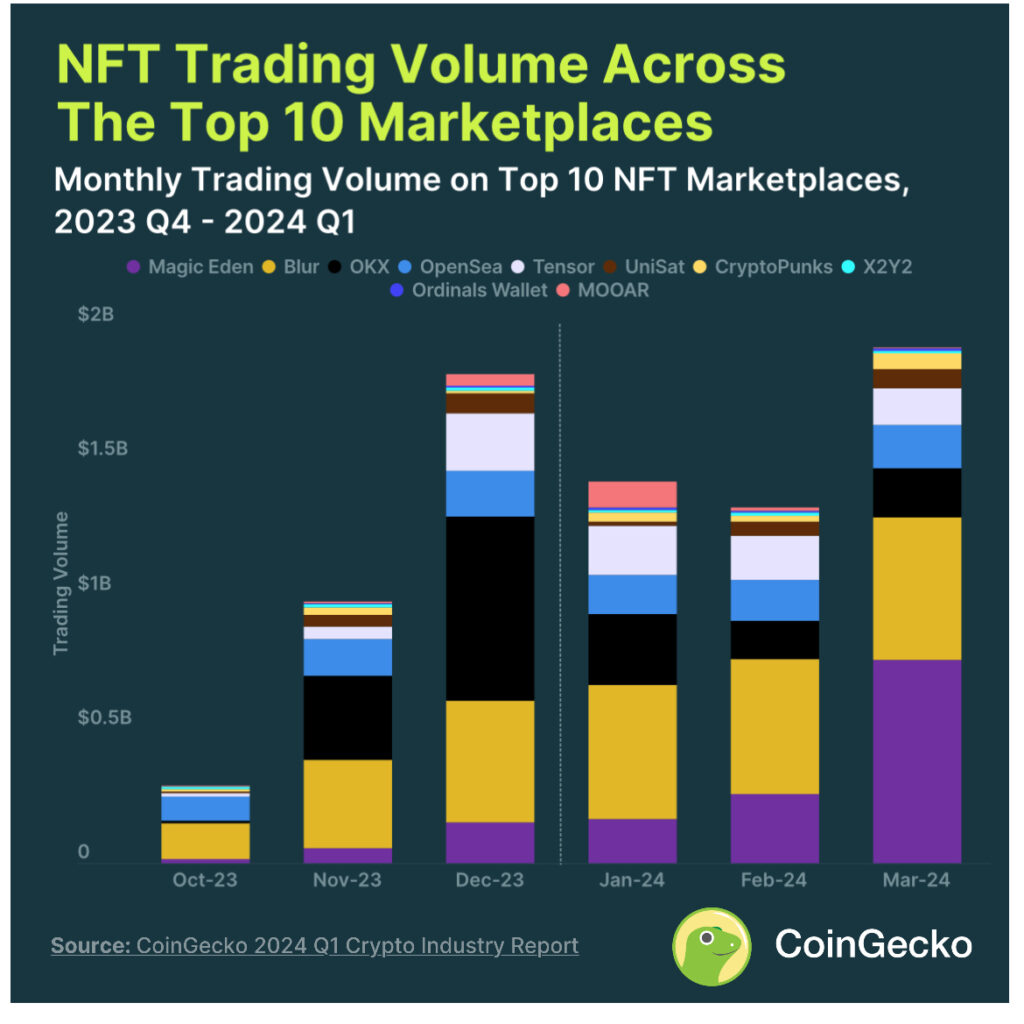

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>