- Test Release

This is test

]]>

- Exhibition space sold out a record month ahead of the world’s largest crypto event

- Speaker highlights include Binance CEO Richard Teng; Solana Founder Anatoly Yakovenko; Oracle Red Bull Racing Formula 1 driver Max Verstappen; Grammy nominee Iggy Azalea; Blueprint Founder Bryan Johnson; prolific entrepreneur Balaji Srinivasan; whistleblower Edward Snowden; and many more

- TOKEN2049’s debut startup competition NEXUS issues final call for innovative early-stage Web3 projects to compete on the world stage, following hundreds of applications

TOKEN2049, the world’s largest crypto event, is set to make history again by shattering all previous records for its 2024 edition. Taking place September 18-19 at Marina Bay Sands ahead of the Formula 1 Singapore Grand Prix 2024 race weekend, TOKEN2049 Singapore will host 20,000 attendees from over 150 countries, solidifying its status as the premier global gathering across the Web3 ecosystem.

With all exhibition opportunities sold out in record time, attendees are strongly advised to secure their tickets promptly before they sell out. Following the overwhelming demand seen at TOKEN2049 Dubai in April, where tickets sold out weeks before the event, TOKEN2049 Singapore is on track for another full-capacity conference.

Formula 1 World Champions, pop culture icons, founders and CEOs across Web3, AI, finance and technology dominate an exceptional, expanded speaker lineup at TOKEN2049 Singapore. New additions include Oracle Red Bull Racing Formula 1 driver Max Verstappen, Grammy-nominated artist Iggy Azalea and Blueprint Founder Bryan Johnson. They join previously announced speakers such as Binance CEO Richard Teng, Solana Founder Anatoly Yakovenko, whistleblower Edward Snowden, prolific entrepreneur Balaji Srinivasan and many more.

Alex Fiskum, Co-Founder of TOKEN2049, commented: “We’re excited to be hosting the largest crypto event of the year. With more than double the attendees from last year and a significantly expanded event space at the iconic Marina Bay Sands, all exhibition opportunities have sold out a record month in advance. We’re expecting 20,000 attendees, and with tickets moving fast, we’re on track to sell out well ahead of the event. We look forward to welcoming the global crypto community to Singapore next month for our most dynamic and immersive TOKEN2049 experience yet.”

Renowned angel investor and entrepreneur Balaji Srinivasan, added: “TOKEN2049 is the largest crypto conference in the world, and it’s held in Singapore. I’ll be updating everyone at the event on our new Network School at ns.com.”

A new highlight of this year’s event is NEXUS, TOKEN2049’s debut startup competition. The premier platform issues a final call for ambitious early-stage crypto projects to compete on a global stage. Selected participants will vie to impress thousands of attendees and a judging panel of foremost venture capitalists, as they journey to become the next crypto unicorn.

TOKEN2049 Singapore’s title sponsors include OKX, a leading crypto exchange and Web3 technology company; BingX, a leading crypto exchange and official partner of Chelsea FC; TRON DAO, empowering decentralised commerce and community for every human on the planet; DWF Labs, the new generation Web3 investor and market maker; Bitget, the world’s leading cryptocurrency exchange and Web3 company; Bullish, one of the fastest-growing, regulated digital asset exchanges, and Zeebu, the Web3 neobank tailormade for telecom settlements.

TOKEN2049 Singapore promises an unparalleled experience that transforms the entire city-state into a hub of innovation and networking. TOKEN2049 Week will feature over 500 side events from September 16-22, ensuring a jam-packed week filled with opportunities for connection and collaboration.

For more information and to purchase tickets before they sell out, visit: https://www.asia.token2049.com/

KEY Difference Wire is a community partner of TOKEN2049 Singapore.

To secure your spot at TOKEN2049 with a 15% discount and meet us at the event use KEYDIFF15.

Alex Fiskum, Co-Founder of TOKEN2049 is available for interview.

The full list of TOKEN2049 Singapore speakers can be found here.

ABOUT TOKEN2049

TOKEN2049 is a global Web3 event series, organised semi-annually in Singapore and Dubai, where decision-makers in the global crypto ecosystem connect to exchange ideas, network, and shape the industry. TOKEN2049 is the preeminent meeting place for entrepreneurs, institutions, industry insiders, investors, builders, and those with a strong interest in the crypto and blockchain industry.

Media Contact

]]>

In a significant milestone, TPRO Network, a project developed by a team of experts from the tokenomics consulting and development company Tokenomia.pro, has successfully rolled out its decentralized platform for token analysis and simulation.

This new platform aims to provide project owners and potential investors with the tools to predict future token behaviors and growth trajectories, making it a crucial resource in the rapidly evolving world of decentralized finance (DeFi).

What TPRO Network Is All About & Why It Matters

It is an award-winning project built by Tokenomia.pro for running Decentralized AI Economic Simulations and Analyses using verified on-chain data with a dedicated platform.

TPRO Network operates with its native token, $TPRO, which is available on both the Polygon and Ethereum mainnets. The token is accessible on Uniswap, Xeggex, and MEXC, offering a versatile and secure option for users engaged in the platform.

Recently, the project has won Future Makers Pitch Competition, which resulted in opening up new market perspectives and garnering support of Santander Bank, a prestigious banking institution.

Platform Features and Unique Capabilities

On TPRO Network Platform, users can analyze and simulate growth scenarios of project tokens’ Primary Market Supply, Market Cap, FDV, Volume, and many other indicators and to add their own custom simulations.

At this moment, over 100 projects’ tokens can be checked, including renown ones such as AI Tech, Bonus Block, or Hive.

Transparency on TPRO Network is ensured for everyone by utilizing verified on-chain data. Independent analysts can also generate tokens predictions for conflict-free results.

The platform’s architecture is built on several distinct layers, each serving a specific function:

- Scoring Engine: It evaluates and ranks various economic models based on the results of simulations, providing users with clear insights into the potential success of different token strategies.

- Simulation Engine: A robust platform for modeling and analyzing economic scenarios, allowing users to explore various outcomes and the implications for token performance.

- Computation Engine: Provides the necessary computational power to run extensive simulations and analyses, ensuring accurate and timely results.

On top of all these, the platform is utilizing TPRO Chain, integrated with other components to support decentralized simulations, analyses, and economic model validations with data integrity and trust across the network.

A New Era for DeFi

The launch of the TPRO Network platform marks a significant step forward in the DeFi and blockchain landscape. By offering a decentralized, transparent, and highly accurate tool for token analysis and simulations, it is poised to become an essential resource for project teams, investors, and other stakeholders looking to navigate the complexities of tokenomics with confidence.

For more information about TPRO Network and to explore its platform, visit https://platform.tpro.network/.

]]>

Mr. KEY Talks AI Governance, Risk & Compliance at Crypto Expo Dubai — KEY Wire TEST

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

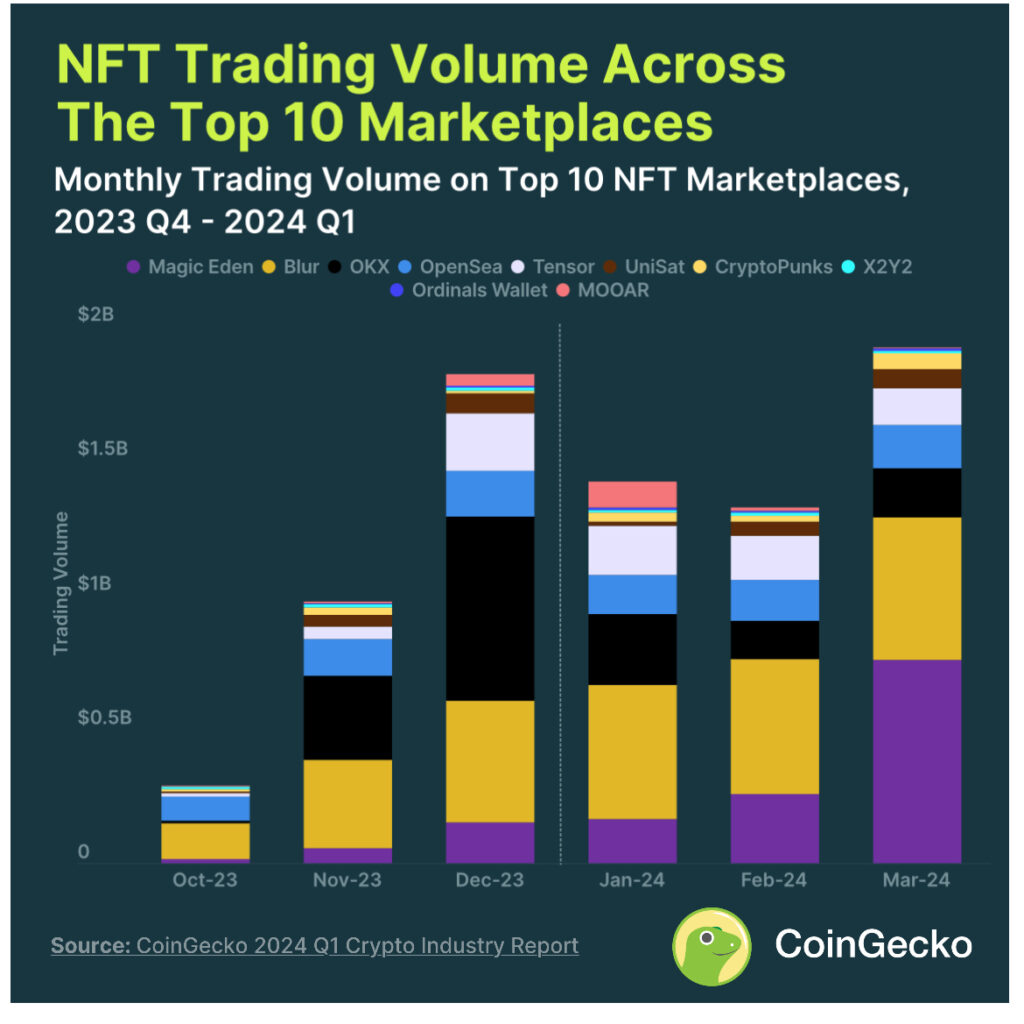

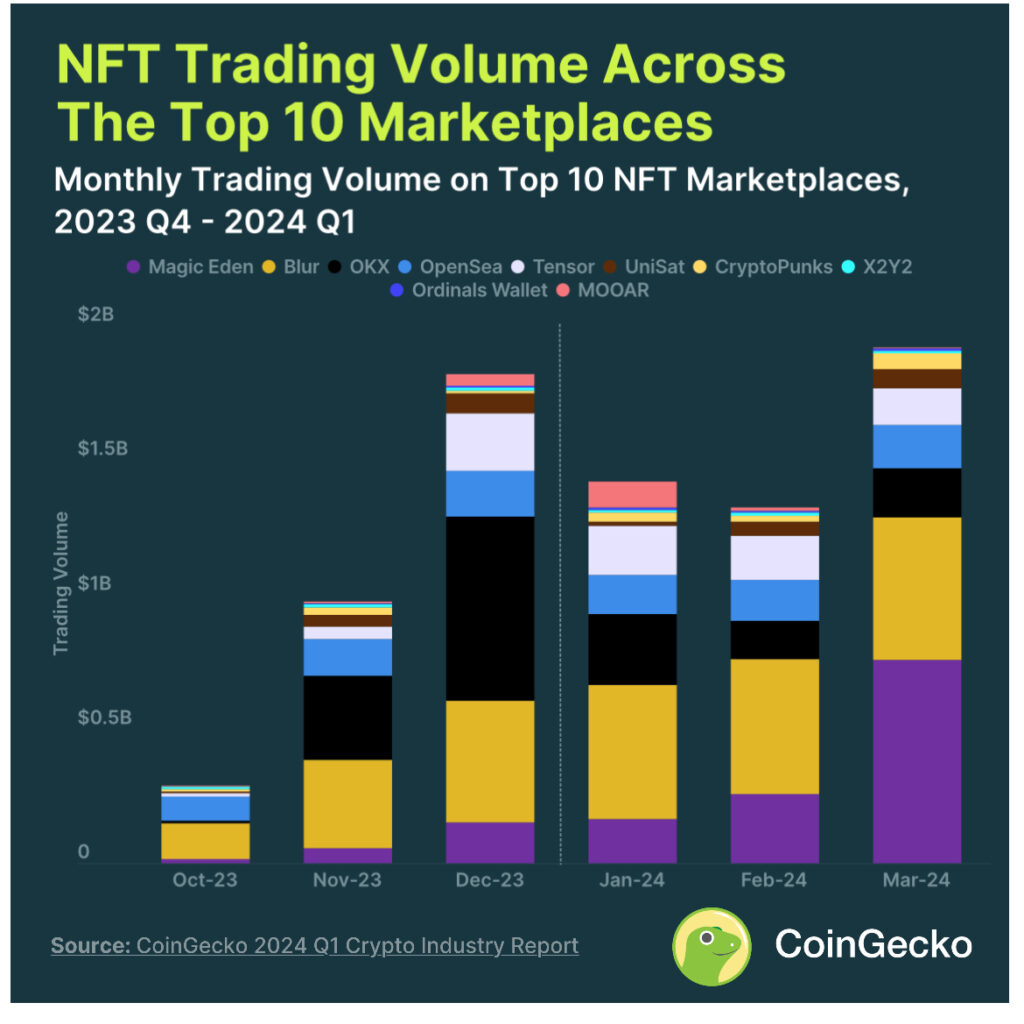

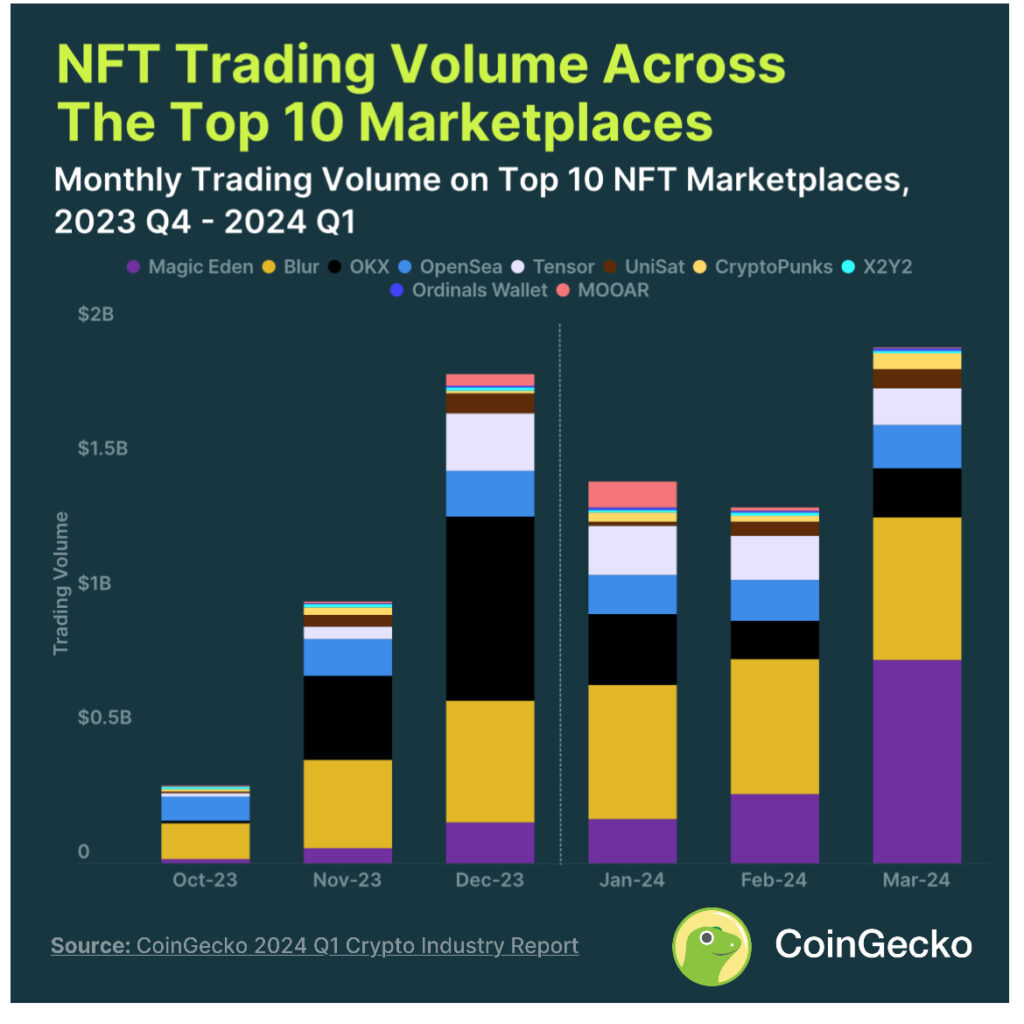

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

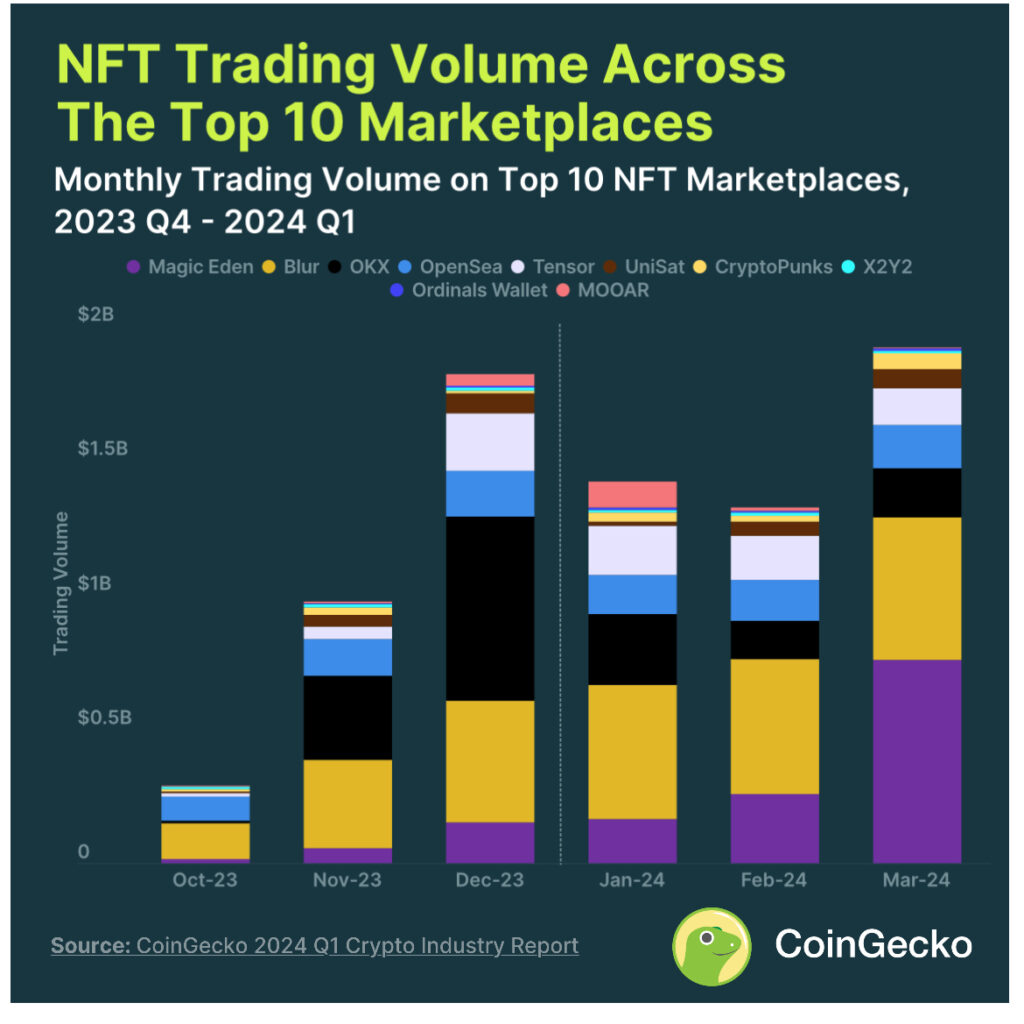

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

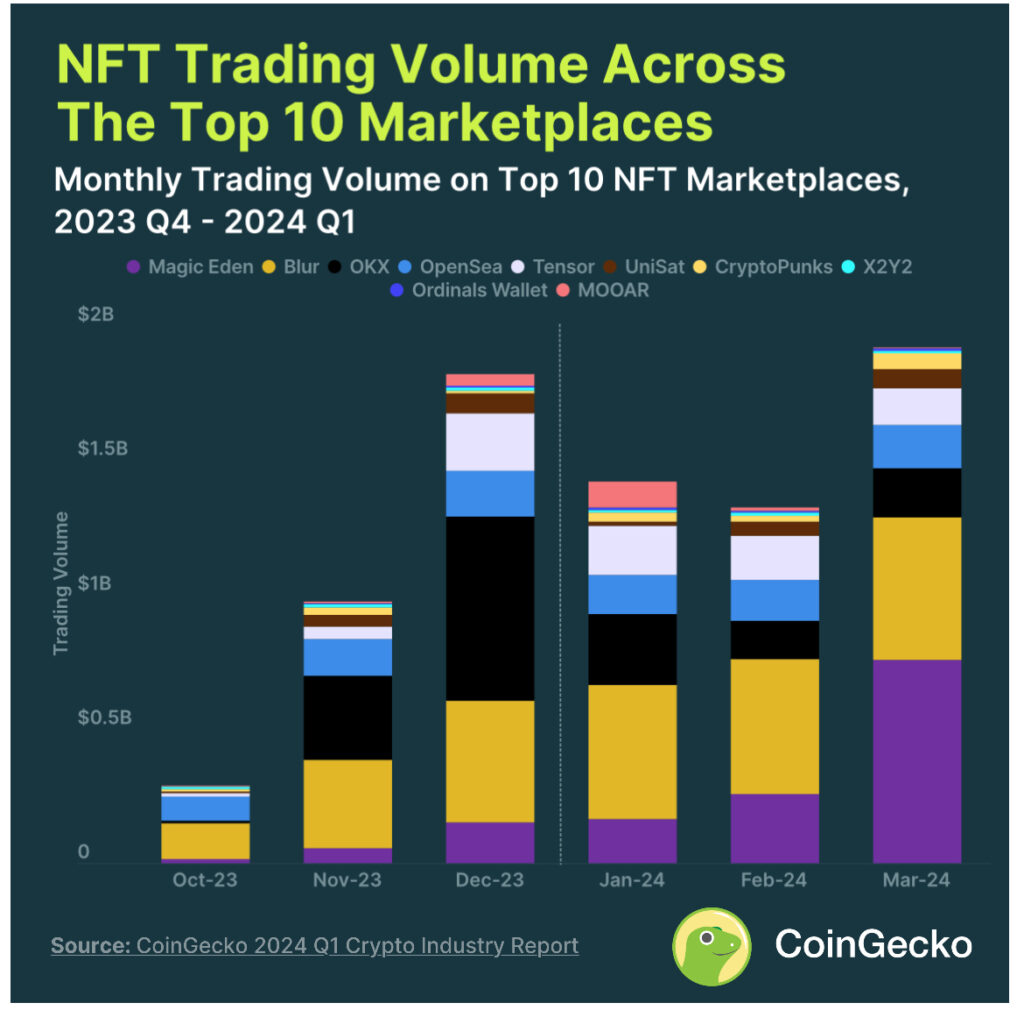

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

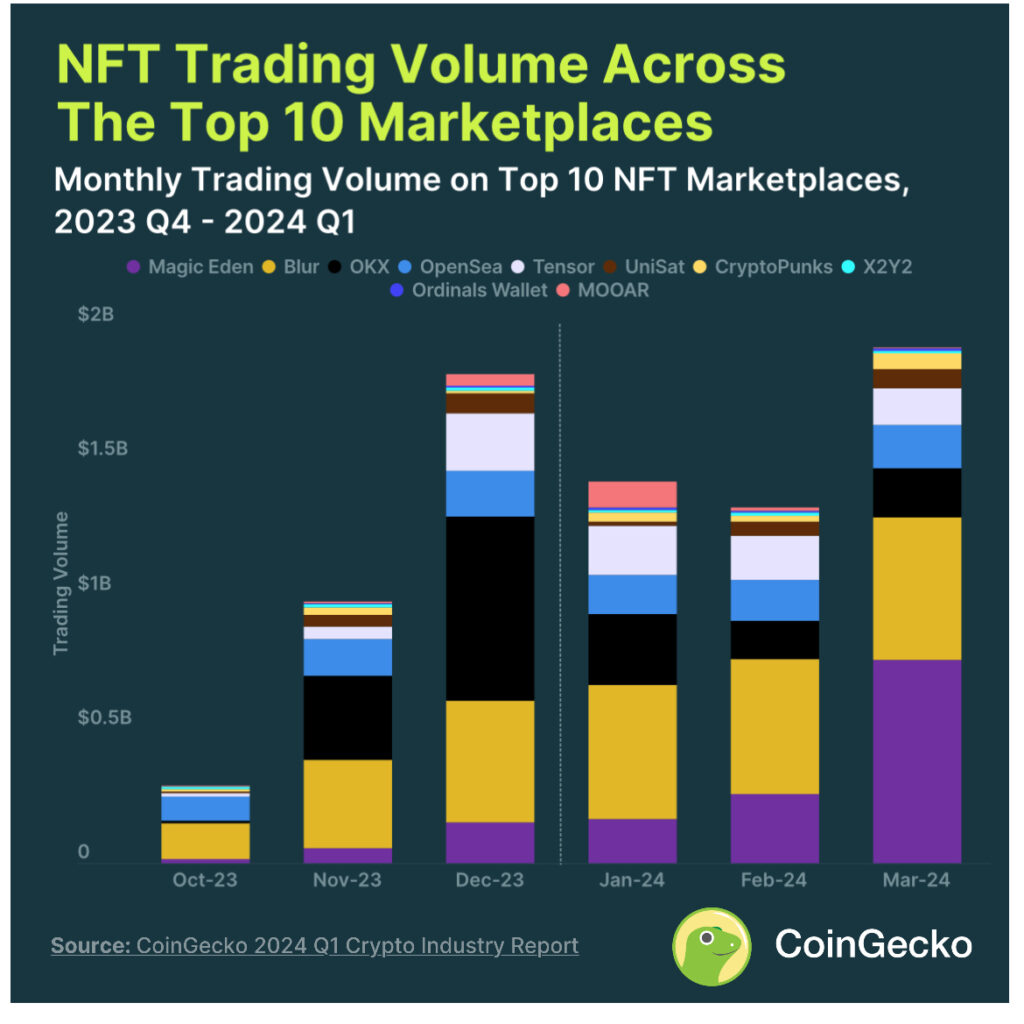

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>

TL;DR

- Solana-based NFT marketplace Magic Eden secured a massive boost in its trading volume in March, surpassing Blur.

- Creator royalties program and its controversies.

Solana-based nonfungible token (NFT) platform Magic Eden enjoyed huge success in March. According to CoinGecko’s Q1 report, the NFT platform registered its biggest trading volume in March, leapfrogging high-flying firm Blur. In the report, CoinGecko highlighted that Magic Eden experienced a jump of about 194% to hit $765 million in trading volume.

Magic Eden achieves a remarkable feat

In the report, CoinGecko noted that Blur experienced slight success last month, registering a trading volume of about $530 million. The report also stated that the success was partly a result of the platform’s Diamond reward program and its extended partnership with Yuga Labs.

Monthly trading volume across Top 10 NFT marketplaces from 2023 Q4 – 2024 Q1. Source: CoinGecko.

The duo fostered their partnership around the period when the platform announced that it was cutting ties with NFT platforms without creator royalties.

The feat in March makes it six consecutive months that the platform has been up in terms of trading volume. The report highlighted that Blur had been the undisputed king of the NFT marketplace trading volume in the last few months before March. The last time a marketplace outperformed Blur was in December when the OKX NFT marketplace saw a surge fueled by Bitcoin Ordinals’ rise. Before that, Blur had posted the highest trading volume for 10 months in a row.

Creator royalties program and its controversies

OKX experienced a decline of about 73% in its trading volume due to losing a huge share of its Bitcoin trading volume to Magic Eden and another marketplace since December. Despite its market volume tanking, OKX came in third place in trading volume with Tensor and Opensea completing the top 5. Furthermore, the top 10 NFT marketplaces registered a cumulative trading volume of $4.7 billion, representing a 51% surge in Q1 compared to the last quarter.

Despite the rise in trading volume, the price of major NFTs has tanked significantly. High-flying projects Bored Ape Yacht Club (BAYC) and CryptoPunks saw a drop of 91% and 64% in their prices, respectively. Notably, both NFTs last hit their peak price in May 2022 and October 2021. NFT marketplaces and studios have been at loggerheads over the enforcement of creator royalties.

OpenSea recently announced that it had dropped its royalty enforcement tool. According to its CEO, Devin Finzer claimed that the tool didn’t experience any success as its rivals were evading it by using the Seaport protocol to avoid its blacklist thereby removing creator royalties. However, the company recently took a step back from this position when it announced its support for ERC-712C programmable earning standard.

]]>